when are property taxes due in will county illinois

Hashbrowns Cafe leases this space from the University of Illinois Chicago at 731 W. Search 34 million in missing exemptions going.

Will County collects on average 205 of a propertys assessed fair market value as property tax.

. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. There is also a 24-hour drop box. Important message regarding the taxes paid to Claypool Drainage District.

Bills for general property taxes due from prior tax years Redemption Forfeiture Redemption or Open Item bills from Tax Year 2019 and prior must be obtained through the Cook County Clerks Office 118 North Clark Street Room 434 Chicago IL 60602. Catalogs available for purchase at the Clinton County Treasurers Office County Courthouse 850 Fairfax St Carlyle IL. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted.

If you have any questions please contact the Treasurers office. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes. Clinton County Delinquent Tax Sale Land Lots Buildings will be held in December 2022 in the Clinton County Boardroom 810 Franklin St Carlyle IL.

The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. Due dates will be as follows.

Search 84 million in available property tax refunds. Cook County collects on average 138 of a propertys assessed fair market value as property tax. For leasehold taxes in Cook County since.

The easiest and fastest way to pay your Cook County Property Tax Bill is online. Payments may be made at the County Office Building 1504 3rd Ave Rock Island in the county treasurers office from 8 am. View taxing district debt attributed to your property.

Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

2022 Property Taxes By State Report Propertyshark

The Cook County Property Tax System Cook County Assessor S Office

Online Payment System Tim Brophy

North Central Illinois Economic Development Corporation Property Taxes

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Property Tax Prorations Case Escrow

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Property Taxes By State In 2022 A Complete Rundown

No Delay This Time Ford County Property Tax Bills To Be Mailed Friday Ford County Chronicle

Youtube Language Subscrib And View Gk Knowledge Youtube Knowledge

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Property Tax Mchenry

Property Taxes By State In 2022 A Complete Rundown

Colorado S Low Property Taxes Colorado Fiscal Institute

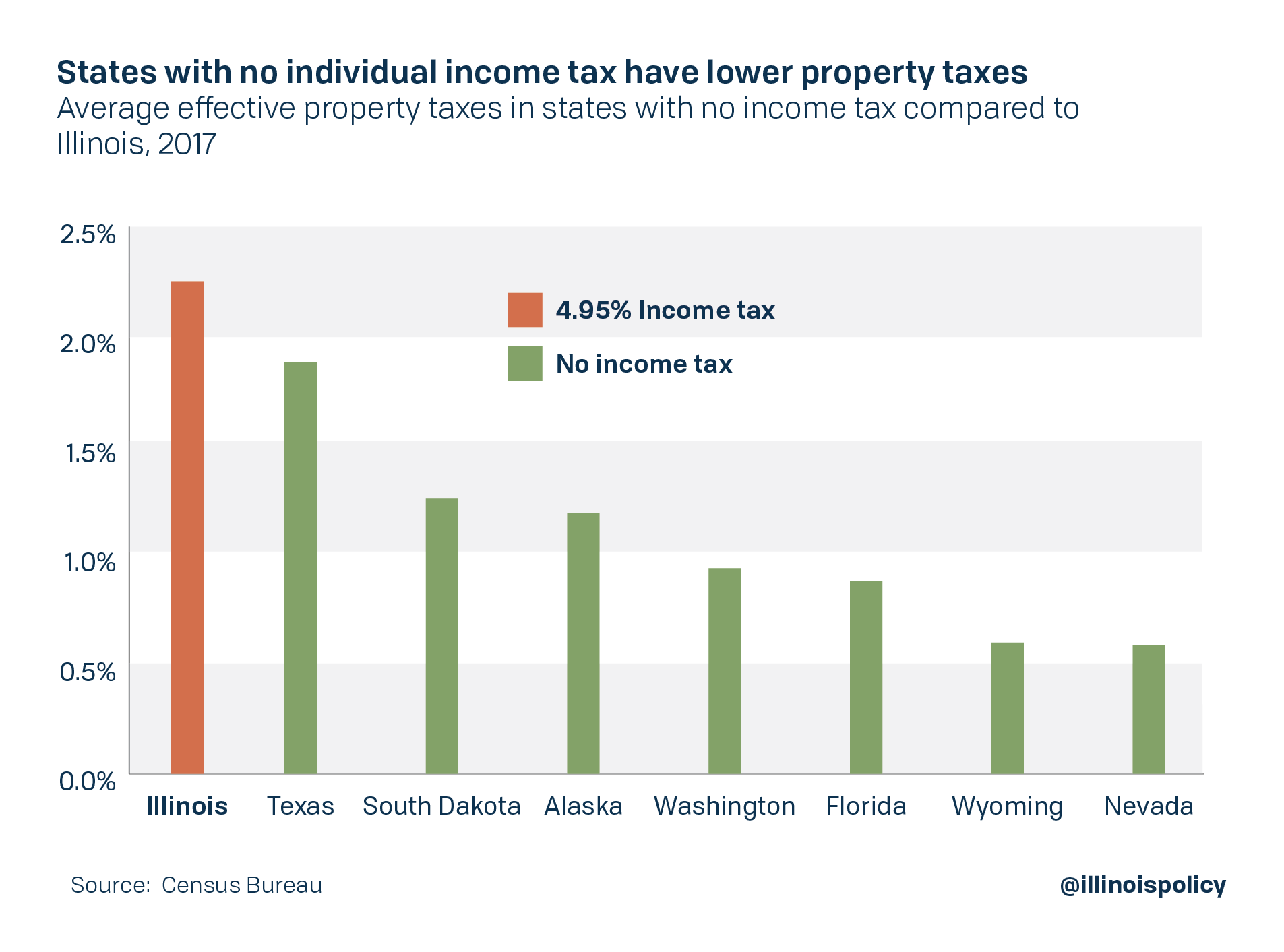

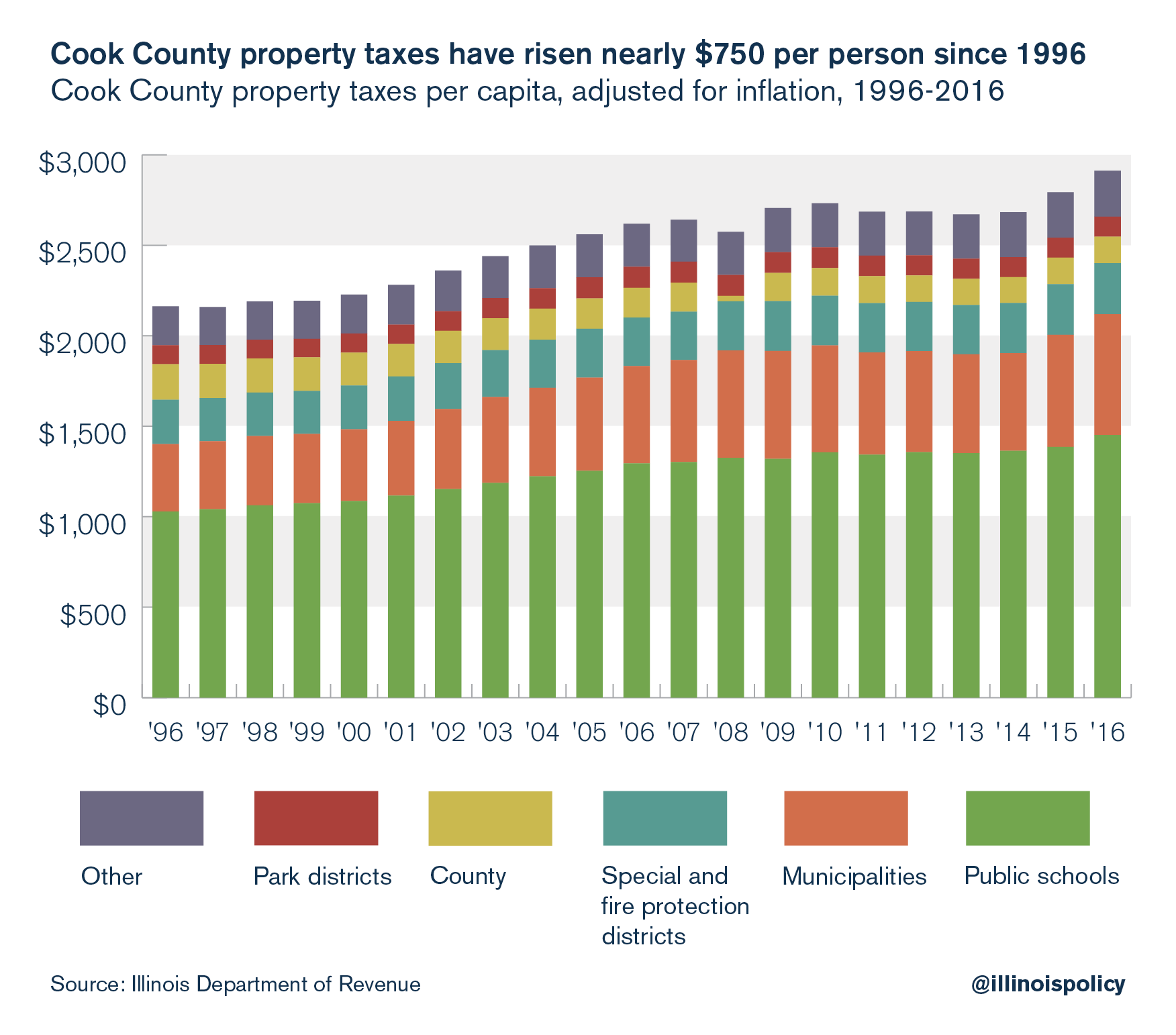

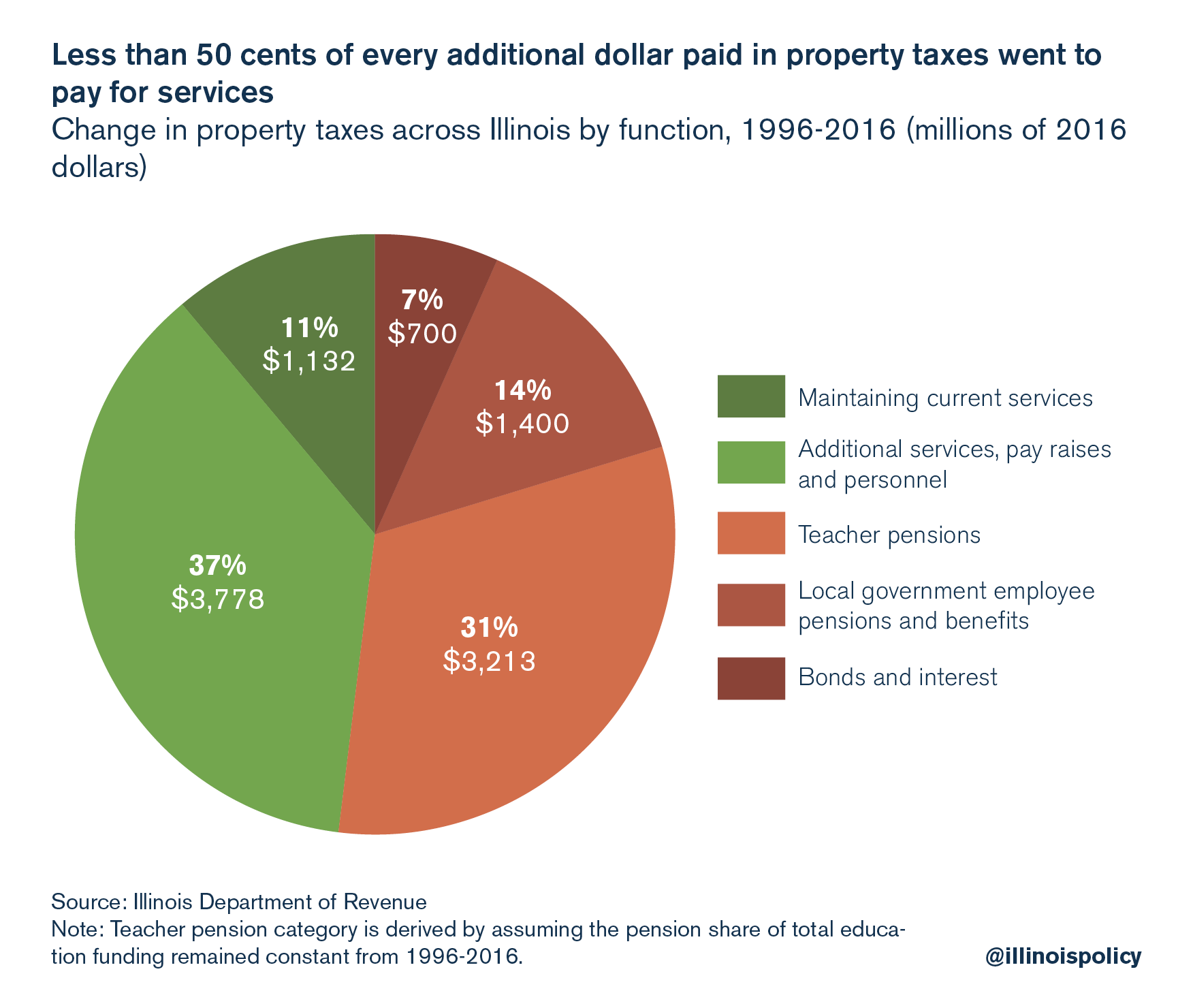

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)